Discounted Cash Flow Valuation in Real Estate Explained

Discounted cash flow valuation is widely used by investors when it comes to decision-making. This is not exclusive to the real estate industry, but rather, this method is intensively applied to myriads of financial dilemmas. In fact it’s the nuts and bolts of finance we’re talking about!

The real estate industry is no exception.

BREAKING DOWN DCF VALUATION

In the world of finance DCF valuation is considered to be a set of procedures applied in order to evaluate the present value of certain cash flows expected to be generated from an investment. As a result, we get a number that represents the estimated market value of an investment, in this case – property. Usually this is exactly how different investments are compared in terms of profitability. That’s right, in finance everything eventually comes down to profitability.

The procedure consists of the following actions:

- Forecasting future cash flows

- Estimating required total return

- Finding the required rate of return

- Discounting the cash flows at the required rate of return

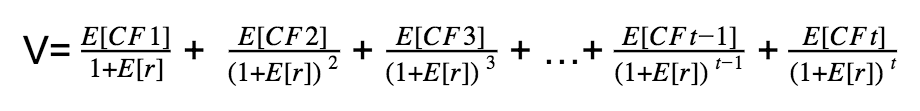

This may seem like a great deal of work, however it is not that complicated really. Mathematically speaking, all those procedures can be summarized under one formula, which may seem tricky at first, however we’ll break it down in no time.

V – represents the value of investment, aka net present value of the investment overall. In fact, one of the methods of calculating value of business firms is exactly the same, meaning, the method takes expected cash flows from business operations and then discounts them based on periods in which they occur. Yes, you figured it right – it has to do with one of the main principles in finance, aka time value of money.

E[CFt] – represents expected cash flow amount during period t. Usually, this period, aka the last period, additionally includes the cash flow generated from selling the property as well. Same happens with financial instruments as well, such as bonds especially – coupons are paid periodically till the end of the last period and by that time the last payment includes both, periodical payment amount and the face value of the bond itself.

E[r]– represents the discount rate. Approximation of this rate has quite a lot to do with in-depth economics and finance. This rate usually includes the risk free rate (aka treasury rate, because treasury securities are considered to be risk free), risk premium, inflation premium, default premium, etc.

HANDS-ON APPLICATION

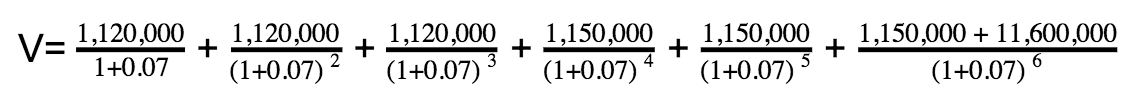

- Let’s assume the subject property under lease is an office building.

- We are in the year 2019 and the building has just been put under a 6 year lease agreement.

- For the first 3 years the rent is negotiated to be an amount of $1,120,000 per year, while for the rest of the 3 remaining years it will be $1,150,000.

- In the end of those 6 years the property is expected to be sold for $11,600,000.

- Having analyzed the financial market and expected returns of real estate versus various financial instrument investments (such as bonds, stocks, options, etc.) you figure the right discount rate is ought to be 7%. Meaning, this is the amount you’d be expecting to receive as a compensation for taking up the project. In other words, 7% is the opportunity cost of capital for this property – what you would in fact expect to receive from investing in projects with similar risks to this one.

Now that we know all the inputs we can simply go ahead and plug them in the Discounted Cash Flow (DCF) formula.

We’ll eventually get that V= $13,132,360.92

So we see that the estimated market value of the property is $13,132,360.92.Wondering if there is an easy way out to avoid doing such boring calculations? With Excel you bet there is:

INTERPRETATION

Alright, now that we’ve got the DCF number let’s go ahead and interpret the idea behind this number.

Think of this number like this: If $13,132,360.92 is the amount of money that we pay for purchasing the same kind of property as we’ve been discussing so far, then 7% (which is the expected rate of return here) will be our average total return for this investment.

Now what would happen if we had the opportunity to pay less than $13,132,360.92 for such property? In this case we’d get average total return of more than 7%. Which is really good for the buyer, but bad for the seller.

Conversely, if we were to pay more than $13,132,360.92, then the average total return for us would be less than 7%. Bad for the buyer, but good for the seller.

BOTTOM LINE

These are 3 main things you most probably have learned from this blog: First is putting DCF valuation to good use. Second is about interpreting the results and making relevant decisions based on that method. And last, but certainly not least – Excel does make life easier. Got a burning question or two? Or maybe some feedback? Let us know about it in the comments down below.

If you enjoy such a bit nerdy blogs about real estate valuation you definitely should check out What is CAP Rate in Real Estate & What Factors Influence Home Value. And if you happen to be a new agent, we have some good news for you, because Realtyna Announces Complimentary Logo Design For New Agents.

Jefin Abraham

Posted at 18:29h, 02 AprilGreat explanation. Thank you for sharing.